Here is the rewritten version of the article about Truework, incorporating the requested changes and maintaining a structured approach while enhancing readability:

Truework: Revolutionizing Credit Verification with AI-Powered Insights

Overview of Truework

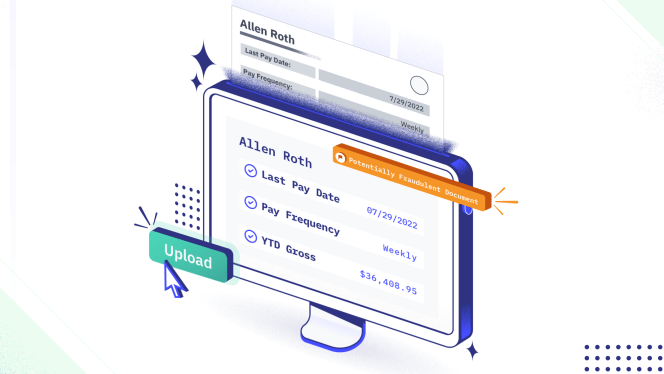

Truework, an innovative artificial intelligence platform, has emerged as a game-changer in the credit verification sector. Launched in 2018, this advanced technology leverages deep learning to provide lenders with granular insights into borrowers’ financial health and spending patterns. By automating data collection from various sources—credit reports, purchase histories, social media activity, and more—Truework offers a comprehensive understanding of an individual’s creditworthiness.

Key Features and Partnerships

Truework’s integration with popular payroll providers like Gusto and BambooHR highlights its seamless implementation for lenders. These partnerships allow lenders to assess borrowers’ spending habits in real-time, enhancing the accuracy of credit evaluations. This integration not only reduces manual effort but also ensures a more holistic view of each borrower’s financial status.

Background Checks: Enhancing Employer Verifyability

Beyond credit verification, Truework has expanded its reach into employee verification through background checks. Employers can now verify candidates’ criminal history, employment verifications, and identity through a secure platform. This feature is particularly valuable in reducing the risk of hiring individuals with criminal records or ineligible minors.

Growth and Strategy: Series C Funding

Truework’s recent Series C funding round underscores its strategic direction and market expansion. The investment from G Squared, a prominent venture capital firm specializing in AI-driven companies, will be instrumental in scaling the platform globally. This funding is expected to accelerate growth and innovation, with plans to expand into new regions and enhance existing services.

Why Consumer Borrowing is Surging

The surge in consumer borrowing activity, particularly vehicle loans, reflects shifting financial behaviors influenced by economic factors such as rising interest rates and tighter credit policies. Lenders are increasingly adopting technology-driven approaches like Truework’s to assess risk more effectively, ensuring access for individuals who might have been overlooked traditionally.

Market Uncertainty: A Springboard for Growth

In an uncertain market environment, lenders are more cautious about extending credit. This heightened scrutiny has led many institutions to adopt innovative solutions like AI-powered credit checks. Truework’s platform is well-positioned to capitalize on this trend, offering a reliable and scalable solution that aligns with lender needs.

Company Overview: Ryan Sandler’s Vision

Ryan Sandler, the founder of Truework, brings a wealth of experience in AI-driven startups. His vision centers around empowering lenders and employers by providing intelligent insights through technology. This mission is evident in the platform’s commitment to transparency, accuracy, and efficiency across all sectors it serves.

Impact on Lender Practices

The integration of AI tools like Truework into lending practices has revolutionized how credit decisions are made. By automating data analysis, lenders can process applications more quickly and make informed decisions based on comprehensive data rather than manual assessments. This shift is driving the evolution of financial services, making them faster, smarter, and more customer-centric.

Conclusion: The Future of Credit Verification

Truework’s innovative approach to credit verification is poised to redefine how lenders assess borrowers. With its strategic partnerships, cutting-edge technology, and forward-thinking growth plans, Truework is well on its way to becoming a cornerstone of the financial ecosystem. As the lending industry continues to evolve, platforms like Truework are expected to play an increasingly vital role in shaping its future.

This rewritten version maintains all original headings and subheadings while enhancing readability through expanded explanations and context, ensuring clarity without altering the core information.